Savings

bank savings accounts

Cash flow is the foundation on which financial planning is based.

A cash flow management plan can allow for discretionary spending, while helping clients manage upfront expenses and still save for their long-term goals.

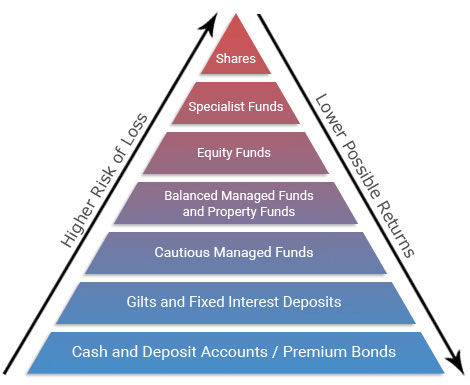

One of the goals of a sound financial strategy is to find the appropriate mix of investments. At the bottom of our illustration are cash alternatives, which have low risk but also offer the lowest potential return. As you move higher up the illustration, each section represents the opportunity for higher potential return, but also carries higher risk.

The reason why cash alternatives are at the foundation of a well-balanced portfolio is that cash alternatives allow you to meet short-term and unpredictable expenses. Having cash and cash alternatives also may allow you to manage other investments — rather than selling at what could be an inopportune time.

Keep in mind that allocating your assets among different investments is an approach to help manage investment risk. It does not eliminate the risk of loss if security prices decline.

For that portion of a portfolio that must be liquid, most investors consider one or more of four places. Each has drawbacks and advantages.

bank savings accounts

time deposits

investment funds

debt-based instruments

Traditional bank savings accounts (savings, checking), are both guaranteed, up to certain limits, by the FDIC. However, traditional bank account returns are modest at best.

Certificates of deposit, on the other hand, are time deposits offered by banks, thrift institutions, and credit unions. They may offer a slightly higher return than a traditional bank savings account, but they also may require a higher amount of deposit.

Money market funds are investment funds that seek to preserve the value of your investment at $1.00 a share. Money held in money market funds is not insured or guaranteed by the FDIC or any other government agency. It's possible to lose money by investing in a money market fund.

Treasury bills are actually debt-based instruments — investors lend money to the government and are paid a specific rate of return. Treasury bills are backed by the full faith and credit of the federal government as to the timely payment of principal and interest.

At any stage in life, it is wise to reserve enough cash on hand to cover your expenses in three areas:

First, you should be able to replace your income for a short period of time in the event of job loss or a loss of investment income. A good rule of thumb is to have enough on hand to replace your income for three to six months.

Second, you should make allowance for emergencies that may occur, such as a catastrophic illness or an accident.

And third, you should have some cash on hand for upcoming large expenses, such as a wedding or an extended vacation.

At the end of the day, the key to financial happiness is not always about having more money. The key is to manage the money you do have well. We can help you do that.

Need guidance on your cash flow position?

Request your complimentary first appointment.